The last few weeks or so have not been such a great time for aficionados of Blockchain technology.

[easy-tweet tweet=”Recent analysis from SWIFT did not make good reading for die-hard fans of #Blockchain” hashtags=”FinTech, Bitcoin”]

First off – I got sight of a detailed analysis conducted by the (worldwide) banks very own SWIFT (Society for Worldwide Interbank Financial Telecommunications) body.

For those of you unfamiliar with this entity – it is a FinTech company of sorts – owned by central and regular banks around the globe and which enables them to (amongst other things) transfer payments in pretty much any currency on a truly global basis. Regardless – the analysis was far from what the die-hard fans of Blockchain wanted to hear.

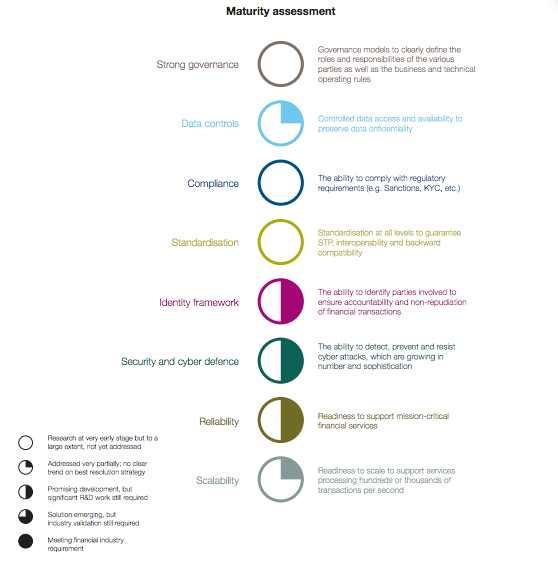

SWIFT’s analysis pointed to the “need for a focus on Distributed Ledger Technology’s abilities to cope with the following key requirements:”

- Strong governance

- Data controls

- Compliance with regulatory requirements

- Standardisation

- Identity framework

- Security and cyber defence

- Reliability

- Scalability

Furthermore, they produced the below graphic depicting the amount of progress DLT has made with regard to each of these categories – notice that three of the requirements have been categorised as “not yet addressed.”

In short, it appears that SWIFT are not overly enthused that as it currently stands, Blockchain technology is actually at a sufficiently mature stage to enable existing/legacy systems to be replaced.

Similarly – a study performed by Morgan Stanley – also arrived at broadly similar conclusions.

Both bodies seem to agree that there exists significant potential cost-saving benefits – but not unless and until all of the issues (compliance, security etc.) are ironed-out – which they feel will likely take between 5 and 10 years from now.

Not to be outdone, Citigroup also published a report which focused on the possibility of DLT challenging existing cross-border and Trade Finance payments systems. The paper – produced by researchers Keith Horowitz, Adrien Porter and Michael Cronin – concluded:

“We don’t view blockchain as an intermediate-term strategic threat to the profitable high-value cross-border payments business for the banks.”

However – in the case of Letters of Credit the outlook was more bullish:

Letter of Credit is a manually intensive process, making it ripe for digitisation. A typical transaction can entail 150 different records and up to 10 different parties signing off on the transaction. Moreover, wrote Horowitz, about 80 per cent of these transactions end up with some form of discrepancy that delays the transaction.

Evidently, a type of smart contract could be developed that would record a transaction’s particulars, codify it through the blockchain, and release the funds only after particular conditions are met, said the Wall Street Journal. “We believe blockchain can help tackle the main challenge of trade today, which is just taking the paper-based process and digitising it, while adding features such as smart contracts that would trigger actions such as payment release and/or shipping of goods,” wrote Horowitz.

Indeed – Barclays Bank announced that they had recently conducted successful tests using so-called Smart Contract technology on a Blockchain platform to trade derivatives.

So currently – it would seem that Blockchain technology can provide benefits only where the number of transactions is relatively small (e.g. it currently could not cope with the thousands of trades per second which are processed currently on Equities/Options markets) and even then – only once the necessary Legal/Compliance issues (to say nothing of the need for ‘Standards’- as in methods to formally identify instrument types, using Legal Entity Id’s/similar, Currency Codes et al) all exist and have been suitably tested.

Various governmental bodies have come forward offering their two-cents (or Bits?) worth of advice:

- The UK government could use distributed ledger technology to track student loans and aid money, according to Minister for the Cabinet Office Matt Hancock.

- Not to be outdone – the ECB came out with: The European Central Bank is looking into the use of distributed ledger technology (DLT) for the Eurosystem’s market infrastructure but is wary of the far-reaching consequences for the role of central bank money

Finally – and just to prove that SWIFT are not entirely without issues themselves – check out the following headline: “Bangladesh Bank hackers compromised SWIFT software, warning issued.”

[easy-tweet tweet=”#Blockchain can currently provide benefits only where the number of transactions is relatively small” hashtags=”FinTech”]

In my next post, I will be illustrating how the currently envisioned three varieties of Blockchain structure proffer different strengths and weaknesses – as well as pointing to which areas of Banking, Trading, Finance generally will likely benefit (or not) from what’s available.

Kevin J. Davis, Researcher & Analyst, Compare the Cloud

Kevin has worked continuously in the Financial Services Industry (primarily on the IT side) for over thirty years.

During this time he has worked first-hand on major Industry Initiatives both in the U.K. and the USA – such as TALISMAN, TAURUS, CREST, (the Bank of England’s) CGO, Counterparty/Client/Settlement Risk Reporting, CHAPS, Model A and B type Clearing, Intra-Day Payment Netting, Capital Gains Tax Reporting, Regulatory Reporting, Trading Interfaces (from DOT through to FIX API’s and beyond), Multi-Instrument and Multi-Currency systems, Direct Market Access and Custodian Services.

As a result, Kevin boasts a wealth of experience and knowledge regarding the latest FinTech innovations.

Comments are closed.