Short term profits rise – longer term hit to profitability

It was been well documented that the Digital and Tech sector will be hard hit by Brexit – as EU born, talented workers – coders, designers, innovators and entrepreneur risk takers – begin to look outside the UK for their future employment and to start-up their next venture.

The suggestions are that small Digital and Tech firms will be hardest hit, as they lack the budget and resources to apply and pay for visas for existing/new employees. Are you worried about this? Explore your options and how to start planning here.

But let’s look at the overall cost of Brexit on Digital and Tech firms;

“What are the £ costs of Brexit to Digital and Tech firms? And are there any benefits?”

The Brexit Tracker has been built to calculate these – and provide a Brexit dashboard to monitor every Brexit related item. So we created a Brexit Tracker profile for an average Digital and Tech firm and discuss the results here.

First of all, what is an “average” Digital and Tech firm? 10 minutes of online research suggests it will have 31 employees, established 4 years ago and be doubling its turnover every 2-3 months, having raised c. £3m of seed capital. The wage bill is their biggest monthly cost. It will be largely UK centred, with increasing EU and global sales and revenue generation.

Excellent case studies of larger Digital and Tech firms are in the Future Fifty programme.

With up and coming firms in Tech City’s Upscale 2017 programme.

So we loaded these stats to create a Brexit Tracker Digital and Tech firm profile.

This considered the impact on Operating profits from over 390 economic indicators, assessing the net effect on a firm’s Op profits due to; movements in currency, changes in UK economic growth rate, employment and wage, EU and Rest of the World imports/exports costs, (all specific to the Digital and Tech sectors) as well as changing consumer and business confidence.

The net impact of all these for our firm’s operating profit is not entirely bad, as seen in the monthly summary – pre and post the Brexit referendum:

Impacts Explained:

Net currency benefits, a resilient UK economy and B2B and B2C confidence with relatively stagnate Digital and Tech wage demands has kept the firm monthly profits positive. The often forgotten reduction in base rate in August 2016 (0.50% down to 0.25%) also generates higher operating profits, as debt interest costs fall.

The Tracker also forecasts future Operating profits – using the user’s views on Brexit related issues.

We anticipated the possible thoughts of the owner of this made up firm; she is worrying how to retain her EU sourced highly skilled talent pool, fears the associated drain of innovation on the firm’s capabilities post-Brexit and is concerned about losing access to the Single Market.

Yet she is also excited about the opportunities of opening up new international sales, supported by new Government back initiatives.

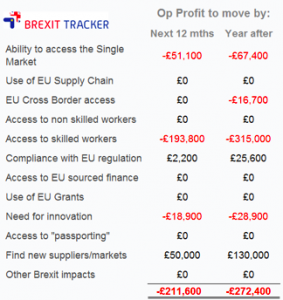

The Tracker provided a summary forecast of what could happen to the firm’s Operating profit over the next 2 years if their Brexit views are realised

And it’s not great news:

- £211k net cost of Brexit in the next 12 months

- Rising to a £272k net cost for the following year.

But it is important to recognise these are forecast impacts of Brexit on the firm – over and above the actual economic factors we reviewed first. Both sets of data need to be considered in planning scenarios.

[easy-tweet tweet=”Brexit is undoubtedly going to impact Digital and Tech firms” hashtags=”Brexit,Digital”]

Our conclusions

Brexit is undoubtedly going to impact Digital and Tech firms – and economic and market changes are already having a direct impact on costs and revenues.

“But owners, directors and stakeholders must not assume Brexit will be just bad news”

There are influences that have already increased their firm’s revenues or reduced their costs. It is important to recognise these variables – differing in magnitude and application for each and every firm – to then begin to plan for the continued changes that Brexit will bring.

How does your firm win from Brexit?

It is vital to know where your firm is now and what has already happened with associated impacts.

Here’s our 5 point plan:

- Research the firm’s differing management views on Brexit to understand what could happen and what are the pain points – and possible profits opportunities.

- Assign individual responsibility for planning for Brexit provide them with the appropriate resources to collate all views and to build a robust reporting framework.

- Agree Key Performance Indicators, a timeframe and reporting procedure – preferably into the Boardroom (or relevant stakeholder meeting.)

- Invest into Brexit related training and education courses, review Brexit consultancy services or begin your planning by creating your own management information via an off the shelf package like The Brexit Tracker.

- Frequently monitor and discuss Brexit impacts as part of your overall plan and communicate responses to the entire firm as appropriate.

And finally note what Dwight D. Eisenhower said;

“Plans are nothing; planning is everything.”

About The Brexit Tracker

The Brexit Tracker analyses over 390 economic indicators pertinent to the sector and a firm’s particular circumstance. Stakeholders use their dashboard to understand likely implications for their business and compare their views with those of their peers. The tool enables the expensive resource to be smartly invested in strategic planning, not squandered in trying to make sense of a myriad of factors that may or may not be relevant to the business.

Ben Martin’s aims are to use technology and big data to assist UK businesses – by creating easy to use, online services that can be used to solve common problems within the business world. The Brexit Tracker is the second big data dashboard Ben Martin has created for business, as he also founded explainmybanking.co.uk – an educational tool for SMEs to improve their business banking and reduce their costs.