“PUT IT IN THE CLOUD”

This month we look at cloud storage. Can it be used as an indicator or predictor for wider cloud dynamics. In other words what do market dynamics in cloud storage tell us about the wider cloud market?

It is always hard to determine cause from effect – you’re often either in the ‘chicken came first’ or ‘egg came first’ camp – or indecisively in both. And often even identifying any form of direct correlation between different factors or markets can be nigh on impossible.

We were fascinated by a recent Gartner Magic Quadrant for Public Cloud Storage Services. In 2014 Gartner postulated that AWS and Microsoft were the leaders in the market for public cloud storage services with Google as a possible challenger and IBM, HP and Rackspace as niche players.

This year AWS, Microsoft and Google as leaders with Rackspace, IBM, AT&T and Version as niche players (HP having been dropped) – get a copy of the full report here.

The most interesting observation was quite how clearly Gartner see the market split between leaders and niche players – with this Gartner Magic Quadrant particularly unusual for not featuring any visionaries or challengers at all.

This is of course Gartner’s analysis for public rather than private cloud storage services, but it makes stark reading for OpenStack advocates. At its recent Vancouver summit much of the chatter was about storage, with our correspondents meeting many innovative players. At the same time, HP and other OpenStack advocates refused to concede that OpenStack had lost the public cloud market to the mega-scale vendors and that it was now in effective a niche private cloud standard, along with VMware.

It is hardly heartening therefore for such advocates for HP to have been dropped from the most recent Gartner Magic Quadrant and for the gap between the leaders and niche player to have widened with OpenStack only represented among the niche players.

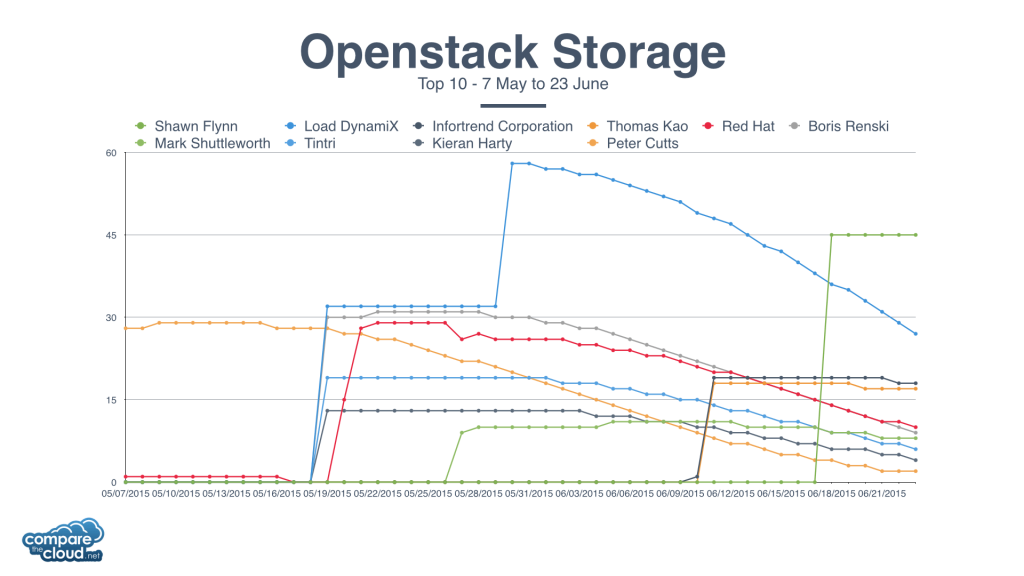

We decided to do a #CloudInfluence Special Report on Storage with a special focus on both OpenStack Storage and AWS Storage. Looking at the last few weeks starting on 7th May a week ahead of the Vancouver OpenStack Summit, we see that the 10 companies or individuals grabbing the most attention discussing OpenStack storage were as follows:

[table id=33 /]

Topping the list was Shawn Flynn, IT Infrastructure manager for Servers and Storage at Progressive Waste Solutions who was quoted in regard to the firm’s adoption of Breqwatr Cloud Appliance for rapid deployment of an OpenStack private cloud. He was followed by Load DynamiX the leader in storage infrastructure performance validation and Infortrend Technology, the Taiwanese technology company specialising in SAN and NAS storage systems.

Other notable individuals were Thomas Kao, the senior product planning director at Infortrend, Boris Renski, the Co-Founder & CMO at Mirantis and also OpenStack Foundation board member and Mark Shuttleworth, Founder of Canonical Ltd.

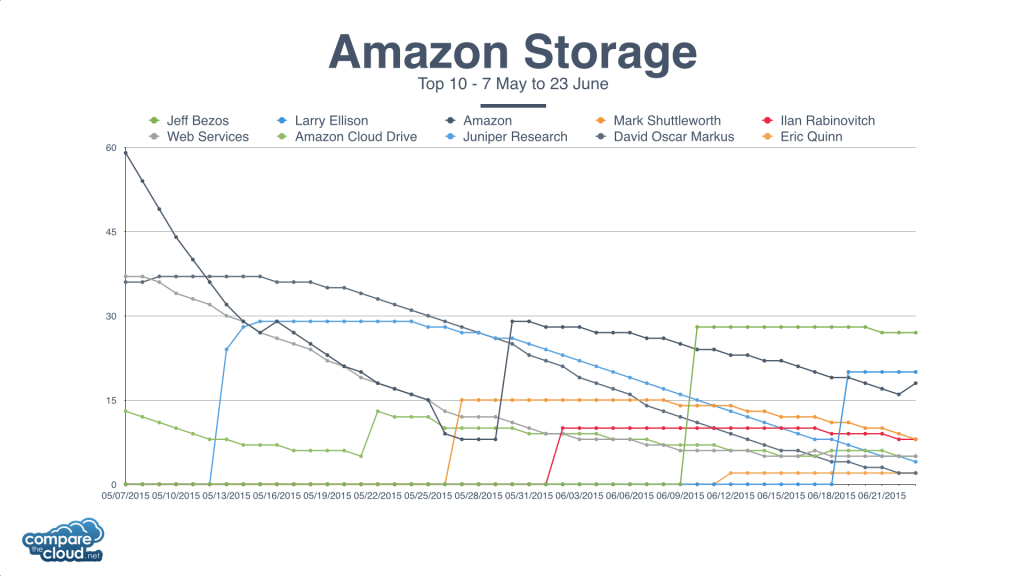

We compared the level of activity and attention with a similar analysis for AWS storage over the same period. It is possibly unsurprising to see Jeff Bezos, Amazon’s CEO appear or indeed Amazon itself as well as Amazon Cloud Drive and Amazon Web Services. Others to appear were Larry Ellison who singled out AWS as his main target saying: “We’re prepared to compete with Amazon on price.” Mark Shuttleworth also appeared commenting on AWS as well as OpenStack, as did Ilan Rabinovitch at Ooyala commenting on multi-cloud management

[table id=34 /]

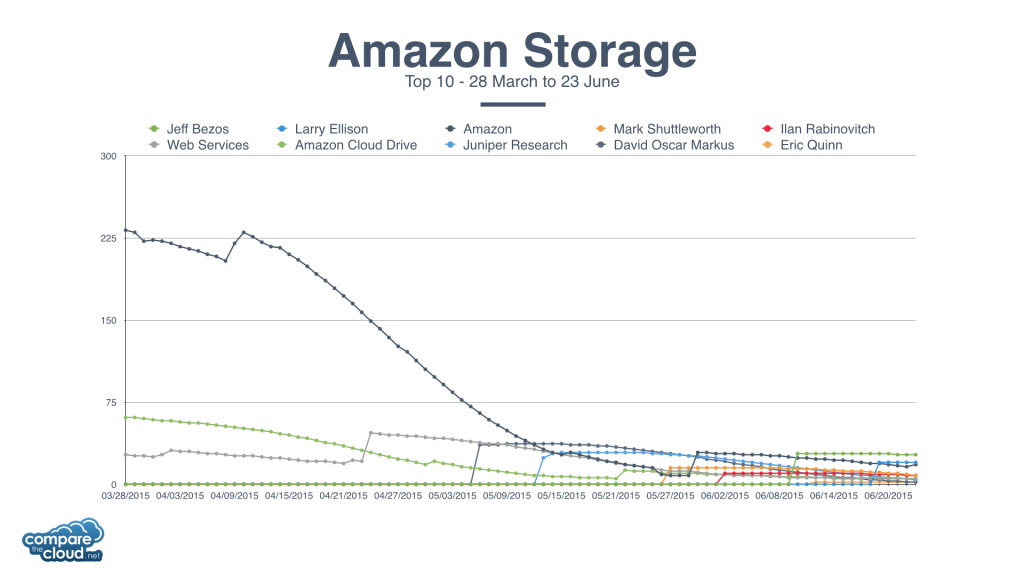

Looking at the level of activity and attention for both OpenStack Storage and AWS Storage over this period might give the impression that there was an even balance between the two, but this belies the fact that the Vancouver OpenStack Summit represented a peak in activity for OpenStack. Extending the time period for AWS shows that there was a massive peak of media and social interest in AWS storage a few months ago (when Amazon broke out the AWS financials for the first time).

As great as the buzz was at the Vancouver OpenStack Summit, and as numerous the number of storage announcements, they represent little more than a blip in attention when compare to AWS. In the same way the impressive turnout in Vancouver would be dwarfed by the cumulative attendance of the various regional AWS summits. All this supports the picture given by Gartner in its public cloud storage services analysis of a market for cloud storage services that is being dominated by the mega-scale cloud vendors.

So does this matter and what does it mean for the OpenStack community and for the niche players? Storage is one aspect of cloud that is particularly open to economies of scale, giving a real competitive advantage for the mega-scale vendors. The niche players will need to sustain their focus on added value services and hybrid integration. They will also need to decide whether to leverage public cloud storage services within any hybrid environment or to retain their own cloud storage services. It will be most interesting to see how this unfolds.

NOTE: the Compare the Cloud #CloudInfluence league tables, are based on a broad big data analysis of all major global news, blogs, forums, and social media interaction over the past 90 days. The league tables provide a snapshot taken at a particular point of time of the respective influence of both organisations and individuals over the last quarter. Companies that were particularly active in the given period will feature more prominently.

Bill is a tech industry veteran and experienced corporate marketing and communications professional with over 20 years spent working in blue chip organisations mostly in pan-European and global communications roles. He is also a regular commentator on #Cloud, #SocialSelling and #InfluencerMarketing, as well as a dad with a passion for technology, economics, politics & Arsenal FC.